Finders-Keepers: Scenarios in the Open Market for TV Entertainment | Page 1 by the Generous Contribution Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The.Annenberg.Schoolfor.·

1 ~ELBVISION VIOLENCE PROPILE: ~HE ~URNING POI~ Prom Research to Action Dec8lllber 1993 George Gerbner .. The.Annenberg.Schoolfor.·. .cClmmunication University of pennsylvania Michael Morqan Department of Communication University of Massachusetts, Amherst ii'ancySiqnorie:l:l:i Department of Communication University of Delaware contents The Violence Profile The Violence Index Trends Flap over measurement The Dynamics of Violence Is violence avoidable? A calculus of risks Cultivation Analysis Patterns of response The "Mean World" Syndrome "Mainstreaming" The Structural Basis of Violence Concentration, conglomeration, globalization Public backlash From research to action 2 TELEVXSXON VXOLENCE PROFXLE NO. 16: THE TURNXNG POXNT From Research to Action December 1993 ·(!,Gns·erns a·bout television violence -- as about violence in other media -- have led to much research and controversy since the earliest days of the medium. Yet, despite political shifts and technological developments, the debate has remained at a virtual standstill. That is, until the 1992-93 television season. '"rhat'wasa' time of turning-point in the television violence debate. Agitation, legislation, high-level consultation, grass-roots organization and even implausible scapegoating ("television made me do it!") moved up high in public attention and the political agenda. By year's end, discussion about television violence saturated the media almost as much as its subject matter. The cultural climate was ripe for action. The only question was what kind. This Violence Profile (16th in the series) also goes beyond the usual research on trends. It attempts to change some terms of the debate and to suggest action alternatives. We note that, despite some muting of dramatic violence, the deeper problems of its burdens and dynamics still persist. -

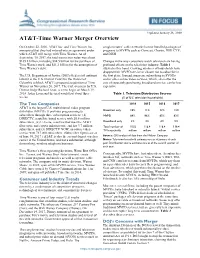

AT&T-Time Warner Merger Overview

Updated January 26, 2018 AT&T-Time Warner Merger Overview On October 22, 2016, AT&T Inc. and Time Warner Inc. conglomerates’ cable networks license bundled packages of announced that they had entered into an agreement under programs to MVPDs such as Comcast, Charter, DIRECTV, which AT&T will merge with Time Warner. As of and DISH. September 30, 2017, the total transaction value was about $105.8 billion, including $84.5 billion for the purchase of Changes in the way consumers watch television are having Time Warner stock, and $21.3 billion for the assumption of profound effects on the television industry. Table 1 Time Warner’s debt. illustrates this trend. Growing numbers of households have dropped their MVPD service or chosen not to subscribe in The U.S. Department of Justice (DOJ) filed a civil antitrust the first place. Instead, many are subscribing to SVODs lawsuit in the U.S. District Court for the District of and/or other online video services, which, even after the Columbia to block AT&T’s proposed acquisition of Time cost of separately purchasing broadband service, can be less Warner on November 20, 2017. The trial, overseen by U.S. expensive. District Judge Richard Leon, is set to begin on March 19, 2018. Judge Leon said the trial would last about three Table 1. Television Distribution Sources weeks. (% of U.S. television households) The Two Companies 2014 2015 2016 2017 AT&T is the largest U.S. multichannel video program distributor (MVPD). It provides programming to Broadcast only 10% 11% 12% 13% subscribers through three subscription services: (1) MVPD 88% 86% 85% 82% DIRECTV, a satellite-based service with 20.6 million subscribers, (2) U-Verse, a service that uses the AT&T Broadband only 2% 3% 4% 5% fiber optic and copper infrastructure and has 3.7 million Total number of 115.5 116.4 116.4 118.4 subscribers, and (3) DIRECTV NOW, an online video TV households million million million million service with 787,000 subscribers. -

Ftc-2018-0091-D-0015-163436.Pdf

December 28, 2018 The Honorable Joseph Simons Chairman Federal Trade Commission 600 Pennsylvania Avenue, NW Washington, DC 20580 Dear Chairman Simons, Thank you for inviting public comment on the question of whether U.S. antitrust agencies should publish new vertical merger guidelines, and how those guidelines should address competitive harms, transaction-related efficiencies, and behavioral remedies. We submit these comments on behalf of the Writers Guild of America West (“WGAW”), a labor organization representing more than 10,000 professional writers of motion pictures, television, radio, and Internet programming, including news and documentaries. Our members and the members of our affiliate, Writers Guild of America East (jointly, “WGA”) create nearly all of the scripted entertainment viewed in theaters and on television today as well as most of the original scripted series now offered by online video distributors (“OVDs”) such as Netflix, Hulu, Amazon, Crackle, and more. The Non-Horizontal Merger Guidelines (“Guidelines”), originally issued in 1984,1 are the governing document of U.S. vertical antitrust enforcement. They rely, however, upon outdated economic theories that not only fail to promote and protect competition, but, in some cases, obstruct appropriate antitrust enforcement. Large vertical mergers in key industries have caused harm to consumers and failed to deliver on their promised innovations, efficiencies, and public benefits. The current Guidelines’ bias toward false negatives, or non-findings of harm, enables incumbents to consolidate market power and undermine competition. Recent vertical mergers in the telecommunications and entertainment industries illustrate the deficiencies of the current regulatory regime and provide evidence of the need for new guidelines. -

X********X************************************************** * Reproductions Supplied by EDRS Are the Best That Can Be Made * from the Original Document

DOCUMENT RESUME ED 302 264 IR 052 601 AUTHOR Buckingham, Betty Jo, Ed. TITLE Iowa and Some Iowans. A Bibliography for Schools and Libraries. Third Edition. INSTITUTION Iowa State Dept. of Education, Des Moines. PUB DATE 88 NOTE 312p.; Fcr a supplement to the second edition, see ED 227 842. PUB TYPE Reference Materials Bibliographies (131) EDRS PRICE MF01/PC13 Plus Postage. DESCRIPTORS Annotated Bibllographies; *Authors; Books; Directories; Elementary Secondary Education; Fiction; History Instruction; Learning Resources Centers; *Local Color Writing; *Local History; Media Specialists; Nonfiction; School Libraries; *State History; United States History; United States Literature IDENTIFIERS *Iowa ABSTRACT Prepared primarily by the Iowa State Department of Education, this annotated bibliography of materials by Iowans or about Iowans is a revised tAird edition of the original 1969 publication. It both combines and expands the scope of the two major sections of previous editions, i.e., Iowan listory and literature, and out-of-print materials are included if judged to be of sufficient interest. Nonfiction materials are listed by Dewey subject classification and fiction in alphabetical order by author/artist. Biographies and autobiographies are entered under the subject of the work or in the 920s. Each entry includes the author(s), title, bibliographic information, interest and reading levels, cataloging information, and an annotation. Author, title, and subject indexes are provided, as well as a list of the people indicated in the bibliography who were born or have resided in Iowa or who were or are considered to be Iowan authors, musicians, artists, or other Iowan creators. Directories of periodicals and annuals, selected sources of Iowa government documents of general interest, and publishers and producers are also provided. -

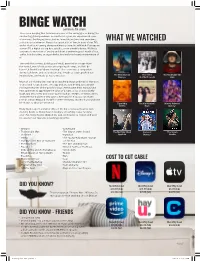

BINGE Watchjourney Via the Screen There Is No Denying That Television Was One of the Saving Graces During the Unrelenting Global Pandemic

BINGE WATCHjourney via the screen There is no denying that television was one of the saving graces during the unrelenting global pandemic. For well over a year, we experienced some of our most challenging times, but we found distractions and sometimes WHAT WE WATCHED solace in entertainment. Many of us spent a lot of time in front of our TV’s and or devices streaming shows and movies from the wild web. Perhaps on a smart TV, a digital set top box, satellite, or on a mobile device. We likely consumed a mountain of snacks and drank a swimming pool worth of tea, coffee, hot chocolate, or sugar drinks. And we loved nearly every minute of it! Time with the screens, both big and small, provided an escape from the surreal, mental exhaustion of navigating the virus, and let’s be honest, it limited our “doom-scrolling”. The screen was a companion during lockdowns and social distancing; it made us laugh, pushed our imaginations, and made us feel connected. The Mandalorian The Office The Handmaid’s Tale Disney + Netflix/Peacock Hulu Much of our viewing time was spent watching shows and movies that were created and released some time ago and are now finding success with reviving memories of the ‘good old days’. At the same time, many found new audiences to appreciate the value of a scare, a cry, or a good belly laugh. Did anyone try and sneak quotes such as, “PIVOT”, or “Bears, Beets, and Battlestar Galactica” into your conversations? If so, you can thank Friends (1994-2004) and The Office (2005-2013) two sitcoms that found new life thanks to what we streamed. -

Streaming Media Pack 2 Important Note

Streaming Media Pack 2 Important Note: Please carefully review the Terms and Conditions of each offer for restrictions and limitations. Please note that some offers are negative option plans, meaning that your credit card will be automatically billed if you do not cancel your trial or subscription within a certain period of time. Sling $10 Promo Sling TV is the live TV you love, only better. Watch live sports, kids shows, breaking news, movies, and more, featuring 30+ top channels like ESPN, AMC, CNN, Disney Channel, and HGTV. Personalize your channel lineup. No useless channels. No long-term contracts. No hidden fees. CuriosityStream Premium 4K $29.97 Promo CuriosityStream is the global streaming destination where viewers of all ages can fuel their passions and explore new ones. Watch thousands of binge-worthy documentary features and original productions in stunning visuals. Get access to every topic imaginable through unrivaled storytelling about science, nature, history, technology, society, lifestyle, and so much more. Daily Burn Premium 3-Month Service Daily Burn Premium Online allows you to stream over 1000 amazing workouts taught by expert, certified trainers. Whether you're a beginner or more advanced, whether you have 15 minutes or 1 hour, there’s a workout for you. Daily Burn helps people have fun and get fit. Come work out with us! DiningAdvantage.com $25 Promo Dining Advantage® by Entertainment® gives you access to over 250,000 coupons, with discounts up to 50% off at more than 55,000 restaurants across the U.S. and Canada. Featuring a variety of cuisines and dining styles, you’ll find instant savings at places you love. -

Bundled Packages1,2 Xfinity

® ® ® 29 1,2 X1 Starter Latino Triple Play 1 Digital Premier Includes Digital Preferred, HBO , Showtime , Starz , TV5MONDE: French With Cinema On Demand $9.99 Gaiam TV Fit & Yoga On Demand $6.99 BUNDLED PACKAGES Includes Starter Latino TV and Streampix for primary outlet, HD XFINITY TV Cinemax®, and The Movie Channel® $144.49 DW Deutsche +: German29 $9.99 Grokker Yoga Fitness On Demand $6.99 Technology Fee, Blast! Pro Internet and Xfinity Voice Unlimited with Basic Latino TV Includes Limited Basic, Xfinity TV Latino, TV Box and Antenna: Greek29 $14.99 Hallmark Movies Now On Demand26 $4.99 Carefree Minutes Latin America 300 $140.00 remote for primary outlet $32.95 QUAD PLAY PACKAGES BASIC SERVICES The Israeli Network29 $19.99 here! TV On Demand $7.99 X1 Preferred Latino Triple Play Economy Latino TV Includes Digital Economy and Xfinity TV Latino for 29 27 ® Rai Italia: Italian $9.99 History Vault On Demand $4.99 X1 Saver Quad Play Includes Digital Preferred, Xfinity TV Latino, Starz and Streampix for Limited Basic primary outlet $42.95 Includes Digital Starter and Streampix for primary outlet, Performance primary outlet, HD Technology Fee, Extreme Pro Internet and Xfinity Italian 2 Pack29 Includes Rai Italia and Mediaset $14.99 Hopster On Demand26 $6.99 Brier, Mill Creek $13.44 Economy Plus Latino TV Includes Economy Latino TV and additional 29 Pro Internet, Xfinity Voice Unlimited Saver and Xfinity Home - Secure $159.95 Voice Unlimited with Carefree Minutes Latin America 300 $160.00 digital channels for primary outlet $52.95 TV JAPAN -

2021-Canadian-Screen-Awards-Rules-Regulations-Change-Highlights.Pdf

FILM AWARDS 1. ELIGIBILITY 1.1. 2021 Canadian Screen Awards Eligibility Period: January 1, 2020 - April 30, 2021 1.2. Feature Film Eligibility 2021 Canadian Screen Awards A Feature Film must be publicly exhibited during the Eligibility Period of January 1, 2020 - April 30, 2021. A Feature Film may qualify by satisfying one of the following qualifying criteria: A. Films that intended a theatrical release during the COVID-19 Pandemic but were made available through commercial streaming on an Academy approved Qualifying SVOD/VOD platform. OR B. A minimum of four (4) screenings in a regular commercial theatre to a paying audience in at least ONE of the following cities: Calgary, Edmonton, Halifax, Montreal, Ottawa, Quebec City, Saskatoon, St. John’s, Toronto, Vancouver, Victoria, and Winnipeg. OR C. Acceptance to an Academy Approved Qualifying Canadian Film Festival along with a release on at least one approved Qualifying VOD/SVOD platform (as specified on the academy.ca/awards website). 1.3. Short Films Eligibility: 2021 Canadian Screen Awards 1. COMMERCIAL SCREENINGS: Short Films Only - During the period of January 1, 2020 through April 30, 2021, a minimum of one (1) theatrical screening to a paying audience other than a festival; or, a commercial release on one of the Academy approved SVOD/VOD platforms. OR 2. FESTIVALS SCREENINGS Animated Shorts and Live Action Short Drama - During the period of January 1, 2020 through April 30, 2021, acceptance into at least two (2) Academy approved Canadian film festivals. OR 1 3. INTERNATIONAL FESTIVAL SCREENINGS: During the period of January 1, 2020 through April 30, 2021, winner of a “Best of” or comparable distinction decided upon by a jury at an Academy approved International Festival or comparable award of distinction. -

Channel's Brochure

Company Overview Summer 2020 2019 Sizzle Reel 2 About CuriosityStream • Created by John Hendricks, founder of Discovery Communications. • Fills the massive void in the marketplace for high quality factual content. • Delivers on the original vision for Discovery Channel with a deep, flexible service offering that enlightens and entertains. 3 CuriosityStream Milestones NOV 2016 JAN-DEC 2018 FEB 2019 MAR 18, 2019 MAR 18, 2015 CuriosityStream More than 30 CuriosityStream CuriosityStream CuriosityStream passes 100,000 distribution raises $140M celebrates 5-year launches in the U.S. active subscribers deals signed in funding anniversary! 2015 2016 2017 2018 2019 2020 SEP 2015 NOV 2017 AUG 2018 JAN 2020 International Emmy win for First linear channel CuriosityStream launch Stephen Hawking’s launch on StarHub passes 13 million Favorite Places in Singapore paying subscribers 4 CuriosityStream: A Comprehensive Multiplatform Offering 24/7 linear channel Mobile App Short-form content feed in SD, HD available for iOS, for mobile/social and/or 4K Android and more media Global slate of Robust SVOD Platform Fully-cleared rights Flexible 4K factual titles featuring library and for mobile, online, commercial models current titles STB and more for bespoke deals 5 Programming • Curated library of 3,000+ premium factual titles, including over 900 originals • Menu spans the entire category of factual entertainment • 350+ 4K Ultra HD titles, growing to 500 • Mix of short-form, mid-form, and long-form content • Long-term licensing partnerships that assure access -

Data-Driven Content Strategy Rules for Media Companies Experts on This Topic

Expert Insights Data-driven content strategy rules for media companies Experts on this topic Janet Snowdon Janet Snowdon is director of IBM M&E with more than 25 years’ experience. Throughout her career, Director, IBM Media and En- she has received numerous accolades, including a tertainment (M&E) Industry Technology and Engineering Emmy Award. She is Solutions also a member of IBM’s Industry Academy. https://www.linkedin.com/in/ janet-snowdon-b160769/ [email protected] Peter Guglielmino IBM Distinguished Engineer and member of IBM’s Industry Academy, Peter Guglielmino leads CTO, Global M&E Industry worldwide responsibility for M&E. In this role, he Solutions develops the architectures that serve as the basis https://www.linkedin.com/in/pe- for media offerings relating to media enabled ter-guglielmino-45118220/ micro-services infrastructures, digital media [email protected] archives, secure content distribution networks, and blockchain technology. Steve Canepa Steve Canepa shapes strategy for video services, cloud and cognitive solutions, and network General Manager, IBM Global virtualization. A member of IBM’s Global Communications Sector and Leadership Team and IBM’s Industry Academy, he Global Industry Managing Direc- is the recipient of three Emmy Awards for tor, Telecommunications, M&E innovation and recognized for his insights in digital Industry Solutions transformation. https://www.linkedin.com/in/ steve-canepa-a70840a/ [email protected] The industry is in the midst of a fundamental shift from the many to the individual. Consumers will dictate how, when, and where they consume media. The queen behind Talking points the content throne Media and telecommunication companies Entertainment companies seldom had a huge need for have an opportunity to capture a slice of data. -

Complete Report

FOR RELEASE OCTOBER 2, 2017 BY Amy Mitchell, Jeffrey Gottfried, Galen Stocking, Katerina Matsa and Elizabeth M. Grieco FOR MEDIA OR OTHER INQUIRIES: Amy Mitchell, Director, Journalism Research Rachel Weisel, Communications Manager 202.419.4372 www.pewresearch.org RECOMMENDED CITATION Pew Research Center, October, 2017, “Covering President Trump in a Polarized Media Environment” 2 PEW RESEARCH CENTER About Pew Research Center Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping America and the world. It does not take policy positions. The Center conducts public opinion polling, demographic research, content analysis and other data-driven social science research. It studies U.S. politics and policy; journalism and media; internet, science and technology; religion and public life; Hispanic trends; global attitudes and trends; and U.S. social and demographic trends. All of the Center’s reports are available at www.pewresearch.org. Pew Research Center is a subsidiary of The Pew Charitable Trusts, its primary funder. © Pew Research Center 2017 www.pewresearch.org 3 PEW RESEARCH CENTER Table of Contents About Pew Research Center 2 Table of Contents 3 Covering President Trump in a Polarized Media Environment 4 1. Coverage from news outlets with a right-leaning audience cited fewer source types, featured more positive assessments than coverage from other two groups 14 2. Five topics accounted for two-thirds of coverage in first 100 days 25 3. A comparison to early coverage of past -

Directv General Market Channel Lineups

DIRECTV GENERAL MARKET CHANNEL LINEUPS ™ SELECT Over 145 channels, including local channels (in SD and HD) available in over 99% of U.S. households: 1 ABC | CBS | FOX | NBC | PBS | CW & MyTV PACKAGE (available in select markets). A&E . HD 265 Church Channel . 371 EWTN. 370 Investigation Discovery . HD 285 Pursuit Channel. 604 truTV . HD 246 ABC Family. HD 311 CMT......................... HD 327 Food Network . HD 231 Jewelry Television . 313 QVC......................... HD 317 TV Land . HD 304 AMC......................... HD 254 CNBC........................ HD 355 FOX News Channel. HD 360 Jewish Life Television 2 . 366 QVC Plus . 315 Univision (East) . HD 402 America’s Auction Network. 324 CNN......................... HD 202 Free Speech TV 2 . 348 Lifetime. HD 252 ReelzChannel. HD 238 Uplift. 379 Animal Planet . HD 282 Comedy Central . HD 249 FX .......................... HD 248 Link TV . 375 RFD-TV . 345 USA Network . HD 242 Aqui 3 ............................401 C-SPAN . 350 Galavisión . HD 404 Liquidation Channel . 226 Rocks TV . 263 Velocity (HD only) 2 .............. HD 281 AUDIENCE ® ................... HD 239 C-SPAN2 . 351 GEB America2 ......................363 MAVTV...........................214 Sale. 319 VH1 . HD 335 AXS TV (HD only)2............... HD 340 CTN . 376 GEM Shopping Network . 228 MSNBC . HD 356 Shopping Network . 309 Vme3 ............................440 BabyFirst TV2 ......................293 Daystar . 369 GOD TV2 ..........................365 MTV......................... HD 331 Son Life Broadcasting Network. 344 WE tv. HD 260 BBC America . HD 264 DIRECTV CINEMA Screening Room. .100/125/200 Hallmark Channel . HD 312 MTV2........................ HD 333 Spike. HD 241 WeatherNation. HD 361 BET . HD 329 Discovery. 278 Hallmark Movies & Mysteries (HD only) 2 HD 565 NASA TV 2 .