Dimensioning Reserve Bus Fleet Using Life Cycle Cost Models and Condition

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

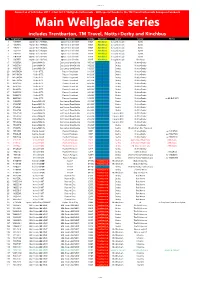

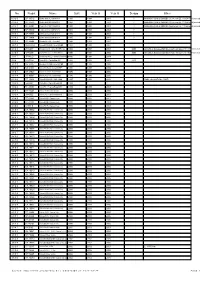

Wellglade Series Includes Trentbarton, TM Travel, Notts+Derby and Kinchbus No

Main series Correct as of 6 October 2017 • Fleet list © Wellglade Enthusiasts • With special thanks to the TM Travel Enthusiasts Group on Facebook Main Wellglade series includes Trentbarton, TM Travel, Notts+Derby and Kinchbus No. Registration Chassis Bodywork Seating Operator Depot Livery Notes 1 YJ07EFR Optare Solo M950SL Optare Solo Slimline B32F Kinchbus Loughborough Sprint 2 YJ07EFS Optare Solo M950SL Optare Solo Slimline B32F Kinchbus Loughborough Sprint 3 YJ07EFT Optare Solo M950SL Optare Solo Slimline B32F Kinchbus Loughborough Sprint 4 YJ07EFU Optare Solo M950SL Optare Solo Slimline B32F Kinchbus Loughborough Sprint 5 YJ07EFV Optare Solo M950SL Optare Solo Slimline B32F Kinchbus Loughborough Sprint 6 YJ07EFW Optare Solo M950SL Optare Solo Slimline B32F Kinchbus Loughborough Sprint 7 YJ07EFX Optare Solo M950SL Optare Solo Slimline B32F Kinchbus Loughborough Kinchbus 8 YN56FDA Scania N94UD East Lancs OmniDekka H45/32F Notts+Derby Derby Notts+Derby 9 YN56FDU Scania N94UD East Lancs OmniDekka H45/32F Notts+Derby Derby Notts+Derby 10 YN56FDZ Scania N94UD East Lancs OmniDekka H45/32F Notts+Derby Derby Notts+Derby 29 W467BCW Volvo B7TL Plaxton President H41/24F Notts+Derby Derby Notts+Derby 30 W474BCW Volvo B7TL Plaxton President H41/24F Notts+Derby Derby Notts+Derby 31 W475BCW Volvo B7TL Plaxton President H41/24F Notts+Derby Derby Notts+Derby 32 W477BCW Volvo B7TL Plaxton President H41/24F Notts+Derby Derby Notts+Derby 33 W291PFS Volvo B7TL Plaxton President H45/30F Notts+Derby Derby Notts+Derby 34 W292PFS Volvo B7TL Plaxton President -

Somerset, England

Fleet Lists - Somerset, England This is our list of current open top buses in Somerset, England BATH - Bath Bus Company Ltd. (City Sightseeing Bath / Tootbus) [RATP Dev / Extrapolitan Sightseeing Group] Buses used for sightseeing tours under the Tootbus brand or City Sightseeing franchise. Fleet List FLEET NO REG NO CHASSIS / BODY LAYOUT LIVERY PREVIOUS KNOWN OWNER(S) 272 EU05 VBG (w) Volvo B7L / Ayats Bravo 1 City PO55/24F BATH NAVIGATOURS / BATH BUS COMPANY (red & black with large white New as part open top, 5/05 Tudor rose) 273 EU05 VBJ (w) Volvo B7L / Ayats Bravo 1 City PO55/24F Bath CitySightseeing / BATH BUS COMPANY (red with yellow flash) New as part open top, 5/05 274 EU05 VBK (w) Volvo B7L / Ayats Bravo 1 City PO55/24F CitySightseeing / BATH BUS COMPANY (red & black) New as part open top, 6/05 301 PN10 FNR Volvo B9TL / Optare Visionaire O51/31F CitySightseeing Bath (red with yellow flash and multicoloured graphics) (withdrawn, Transferred from Windsor to Bath, 2/18; transferred c.2/18) from Bath to Windsor, ?/14; new as open top, 4/10 374 EU05 VBM (w) Volvo B7L / Ayats Bravo 1 City O55/24F BATH BUS COMPANY SIGHTSEEING Serving Bath Since 1997 (red/cream) New as open top, 7/05 381 EU04 CPV (w) Volvo B7L / Ayats Bravo 1 City O55/24F Bath CitySightseeing / BATH BUS COMPANY (red with yellow flash) New as open top, 6/04 617 LJ07 XEU Volvo B9TL / East Lancs Visionaire PO49/31F Bath CitySightseeing (red with yellow flash & multicoloured graphics) Original London Sightseeing Tour Ltd. -

MIM Bus Kits Comprise Polyurethane Resin Bodyshells & Chassis

M24 Volvo Ailsa Van Hool McArdle M32 Leyland Atlantean PDR1 East (OUT OF STOCK) £40.00 Lancs Flat Front (Stock) £40.00 All MIM Bus kits comprise polyurethane resin bodyshells & chassis With metal parts & printer glazing. Not suitable for children under 14 years of age. Bus kit are models not toys. Designed & made in the UK. The model bus kits in this range need building and painting M28 Leyland Leopard East Lancs . EL2000 Rebody (Stock) £30.00 Future kits M17 Volvo B10B Alexander Strider as operated by Yorkshire Rider M22 Dennis Dominator East Lancs as operated by North Western & Leicester Citybus. M4 Merc 811D Alexander AM as operated in London and by Stagecoach AEC Regent V Willowbrook 27foot as operated by Devon & General AEC Regent V or optional engine unit Willowbrook 30foot as operated by Make cheques / postal orders to: A’s Models of Bolton. Devon General – South Wales NBC. Postage & Packaging £3.00 per order Worldwide. Duple Britannia Bristol KSW And send orders to: A’s Models of Bolton, P.O. Box 514, Bolton, Lancs, BL1 5YD. Tel 01204 467961 or Mob 07788 106064 Online website shop accepts the following cards www.mirror-image-models.co.uk Mirror Image Models are produced by A’s Models of Bolton M1 Volvo B6BLE Wright Crusader M6 Volvo Olympian Northern M10 Bedford VAS V Duple M16 Setra S415HD (Out of Stock) £OUT OF STOCK Counties Lowheight Palatine (LATE Dominant Coach C29F (TBA) £TBA (Stock) £35.00 JUNE 2012) £40.00 M11 Volvo Citybus D10M Northern Counties (Stock) £40.00 M2 Leyland Atlantean PDR1 East M18 M.A.N. -

No. Regist Name Built Year O Year O Scrapp Other

No. Regist Name Built Year O Year O Scrapp Other 6325 SP 33512 Gräf & Stift GE110/54/57/A 1980 1998 2003 ? MAN/ÖAF/Gräf & Stift/BBC-Sécheron GE 110/54/57/A (according to Wikipedia) or MAN/Gräf & Stif GSGE 170 M18 (according to Norwegian bus list). 6326 SP 33530 Gräf & Stift GE110/54/57/A 1980 1998 2003 ? MAN/ÖAF/Gräf & Stift/BBC-Sécheron GE 110/54/57/A (according to Wikipedia) or MAN/Gräf & Stif GSGE 170 M18 (according to Norwegian bus list). 6327 SP 34082 Gräf & Stift GE110/54/57/A 1980 1998 2003 ? MAN/ÖAF/Gräf & Stift/BBC-Sécheron GE 110/54/57/A (according to Wikipedia) or MAN/Gräf & Stif GSGE 170 M18 (according to Norwegian bus list). 6333 SP 79839 Gräf & Stift SG200HO M18 1985 1998 2003 ? 6331 SP 79837 Gräf & Stift SG200HO M18 1985 1998 2003 ? 6332 SP 79838 Gräf & Stift SG200HO M18 1985 1998 2003 ? 6518 SP 94494 Scania N112CL / Arna M83 1986 1998 2001 2574 051-41 КА Volvo B10MA-55 / Arna M86BF 1987 1998 2001 2145 201 ART Scania K92CL / Arna M86BF-City 1988 1998 2003 2008 Arna Bruk Karosserifabrikken A/S, Arnatveit <b>3371</b> (1988) 2209 473 AZN Scania K113CLB / Arna M86BF 1990 1998 2006 2009 Arna Bruk Karosserifabrikken A/S, Arnatveit <b>3640</b> (1990) 1017 971 MJD Scania K113CLB / Carrus Classic II 3401992 1998 2004 500 678 TGO Volvo B12 / Carrus Star 501 1993 1998 2003 2013 2173 SR 52887 Scania L113CLB / Arna M91BF 1993 1998 2006 6189 SR 61994 Volvo B10B-60 / Arna M91BF 1994 1998 2006 6109 SR 67923 Volvo B10B-60 / Arna M91BF 1995 1998 2006 6114 SR 85567 Volvo B10B-60 / Arna M91BF 1996 1998 2006 6120 ST 11932 Volvo B10MA-55 / Säffle -

Fleet Archive

Fleet Archive 2020 15 March 2020 Repaints last week included Optare Solo M890/Optare 628 (NK61 DBZ) into “Little Coasters” livery. Volvo B9TL/Wright Eclipse Gemini 2 6004 (NK11 BHE) has also lost its branding for the “Red Arrows”, having been stripped of all vinyls, ahead of the introduction of new vehicles to this service in May. There were no fleet movements last week. 8 March 2020 Repaints last week included Mercedes Citaro 0350N/Mercedes Citaro 5278 (NK07 KPN) and 5279 (NK07 KPO) into the 2019 fleet livery. Scania N94UD/East Lancs OmniDekka 6143 (YN04 GKA) is no longer a float/reserve vehicle and now forms part of the main fleet allocation at Riverside. It has replaced former East Yorkshire Volvo B7TL/Plaxton President 6935 (X508 EGK) which has suffered defects uneconomical to repair. Float Optare Solo M890/Optare 636 (NK61 FMD) is now allocated to Percy Main to provide cover for the remaining “Little Coasters” branded Optare Solo repaints. Scania L94UB/Wright Solar 5226 (NK54 NVZ) has now been withdrawn from service at Riverside and, together with 5231 (NK55 OLJ), has transferred to East Yorkshire on temporary loan. 1 March 2020 The final coach to be repainted as part of the ongoing work into the new Northern Coaching unit is Scania K340EB/Caetano Levante 7098 (JCN 822) into Voyager livery. Notable is the allocation of the registration mark JCN822: this registration mark being allocated to Leyland Tiger/Plaxton Paramount 7038 (E116 KFV) from 1990 to 1997 whilst a part of the Northern fleet in Voyager livery. Scania N94UD/East Lancs OmniDekka 6143 (YN04 GKA) has transferred from Chester-le-Street to Riverside, as a float/reserve vehicle. -

Arriva Yorkshire Fleet List

© http://westyorkshirebusphotos.wordpress.com/ 31/05/2018 Arriva Yorkshire Fleet Registration Body Chassis Seat Livery Depot Notes Num. Code 261 SN55 HTY Plaxton Pointer 2 Dennis Dart SLF B29F Arriva Interurban Selby 262 SN55 HTZ Plaxton Pointer 2 Dennis Dart SLF B29F Arriva Interurban Selby 401 K401 HWW Alexander Strider Volvo B10B N/A Driver Trainer Wakefield Driver Training 403 K403 HWW Alexander Strider Volvo B10B N/A Driver Trainer Wakefield Driver Training 499 YJ04 HJG Wright Commander DAF SB200 B44F Driver Trainer Wakefield Driver Training 703 YD02 PXZ Optare Spectra DAF DB250 H47/27F Arriva Interurban Wakefield 704 YG52 CFA Optare Spectra DAF DB250 H47/27F Driver Trainer Wakefield Driver Training 723 YD02 PYZ Optare Spectra DAF DB250 H47/27F Arriva Interurban Wakefield 1001 YY14 LFM Alexander Enviro200 ADL Enviro 200 B28F Arriva MAX (Big In Yorkshire) Castleford 1002 YY14 LFN Alexander Enviro200 ADL Enviro 200 B28F Arriva MAX (Big In Yorkshire) Castleford 1003 YY14 LFO Alexander Enviro200 ADL Enviro 200 B28F Arriva MAX (Big In Yorkshire) Castleford 1004 YY14 LFP Alexander Enviro200 ADL Enviro 200 B28F Arriva MAX (Big In Yorkshire) Castleford 1005 YY14 LFR Alexander Enviro200 ADL Enviro 200 B28F Arriva MAX (Big In Yorkshire) Wakefield 1006 YY14 LFS Alexander Enviro200 ADL Enviro 200 B28F Arriva MAX (Big In Yorkshire) Wakefield 1007 YY14 LFT Alexander Enviro200 ADL Enviro 200 B28F Arriva MAX (Big In Yorkshire) Wakefield 1008 YY14 LFU Alexander Enviro200 ADL Enviro 200 B28F Arriva MAX (Big In Yorkshire) Wakefield 1009 YY14 LFV Alexander -

Fleet Allocation

FLEET MOVEMENTS (PERIOD 13) DRIVER TRAINING VEHICLES 20551 P551 ESA VOLVO B10M S/Shields to Driver Trainer 20551 P551 ESA VOLVO B10M WA CONVERSION TO D/T 20553 P553 ESA VOLVO B10M S/Shields to Driver Trainer 20553 P553 ESA VOLVO B10M WA CONVERSION TO D/T 21101 P601 JBU VOLVO B10BLE S/Shields to Walkergate 20554 P554 ESA VOLVO B10M WA 21032/4/6 L32-36 HHN VOLVO B10B WA Awaiting Scrap The following VOLVO B10BLE’s have gone from S/Shields to Reserve: 21041/2 M41/2 PVN VOLVO B10B SS/SU Awaiting Scrap 21138 R238 KRG 21148 R248 KRG 21154 R254 KRG 32125 K125 SRH DENNIS DART SL Awaiting Disposal 21145 R245 KRG 21150 R250 KRG 21156 R256 KRG 21146 R246 KRG 21153 R253 KRG 21157 R257 KRG RESERVE VEHICLES The following ADL ENVIRO 300’s are new to S/Shields Volvo Olympians Volvo B10BLE cont 27723 NK11 BFJ 27729 NK11 BFU 27734 NK11 BGE 16704 N704 LTN WA Spare 21155 R255 KRG WA Spare 27724 NK11 BFL 27730 NK11 BFV 27735 NK11 BGF 16705 N705 LTN WA Spare 21156 R256 KRG SS Spare 27725 NK11 BFM 27731 NK11 BFX 27736 NK11 BGO 16707 N707 LTN WA Spare 21157 R257 KRG SS Spare 27726 NK11 BFN 27732 NK11 BFY 27737 NK11 BGU 16730 N730 LTN WA Spare Dennis Dart SLF 27727 NK11 BFO 27733 NK11 BFZ 27738 NK11 BGV Volvo B10M (*B10B) 33101 R101 KRG SS Spare 27728 NK11 BFP 20126 P126 XCN SL Trans. 33118 R118 KRG SU Chassis Fleet 32125 K125 SRH DENNIS DART D/Trainer to Disposal 20253 R653 RPY SL Spare 33489 R469 MVN SS Spare 32624 P624 PGP DENNIS DART Sold for Scrap 20258 R558 RPY SL Spare 33492 R472 MVN SS Spare 33118 K118 KRG DENNIS DART SLF Sunderland to Reserve 20263 N553 VDC SL Spare 33825 R825 YUD SS Spare 33489 R469 MVN DENNIS DART SLF S/Shields to Reserve 20264 R554 RPY SL Spare 33828 R828 YUD SS Spare 33492 R472 MVN DENNIS DART SLF S/Shields to Reserve 20840 P840 GND SL Engine 33829 R829 YUD SU Chassis 33825 R825 YUD DENNIS DART SLF S/Shields to Reserve 20842 P842 GND WA Engine Designline H.E.V. -

Premium Parts the EUROPART Own-Brand Range

www.europart.net Premium Parts The EUROPART own-brand range ■ Engine and clutch ■ Cooling ■ Filters ■ Electrics and lighting ■ Axle and steering parts ■ Springs and dampers ■ Pneumatic system ■ Braking system ■ Body, cab, vehicle equipment ■ Workshop requirements ■ Chemical products ■ Standardised and DIN parts EUROPART – Europe's No. 1 for truck, trailer, van and bus spare parts. www.europart.net EWOS - the optimum ordering and organisation solution. Information and ordering around the clock! EUROPART offers an integrated solution for the workshop, with benefits for purchasing, stock management, repair and organisation: ■ safe and rapid identification, search and assignment of spare parts and accessories. ■ parts for all tractor vehicles, buses, trailers, vans and cars ■ immediate online ordering facility for all bus items ■ immediate information on prices and availability ■ detailed product descriptions ■ technical data for installation, repair and maintenance Catalogue browser The online offer is rounded off with a new catalogue browser. This combines the advantages of the conventional catalogue with digital possibilities. Familiar functions appreciated by the customer such as turning page by page have been usefully enhanced in the online catalogue, with fast navigation by mouse click, an intelligent search function and much more. ■ direct linking into the EUROPART Workshop Online System (EWOS) for rapid ordering ■ innovative and individual presentation of the products www.europart.netwww.europart.net Dear Customers, with this catalogue we would like to give you an overview of our EUROPART brand products. From our comprehensive range of currently more than 6,500 items with the EUROPART brand, we have compiled for you around 2,000 top items from the areas of vehicle technology, workshop requirements, chemical products as well as standard and DIN components. -

Buses That We Don't Have Current Details For

Check List - buses that we don't have current details for The main lists on our website show the details of the many thousands of open top buses that currently exist throughout the world, and those that are listed as either scrapped or for scrap. However, there are a number of buses in our database that we don’t have current details for, that could still exist or have been scrapped. The buses listed on this page are those that we need to confirm the location and status of. These buses do not appear on any of our other lists, so if you're looking for a particular vehicle, it could be here. Please have a look at this page and if you can update any of it, even if only a small piece of information that helps to determine where a bus is now, then please contact us using the link button on the Front Page. The buses are divided into lists in Chassis manufacturer order. ? REG NO / LICENCE PLATE CHASSIS BODY STATUS/LAST KNOWN OWNER J2374 ? ? Last reported with JMT in 1960s, no further trace AEC Regent REG NO / LICENCE PLATE CHASSIS BODY STATUS/LAST KNOWN OWNER AUO 90 AEC Regent Unidentified Devon General AUO 91 AEC Regent Unidentified Devon General GW 6276 AEC Regent Brighton & Hove Acquired by Southern Vectis (903) from Brighton Hove and District in 1955. Sold, 1960, not traced further. GW 6277 AEC Regent Brighton & Hove Acquired by Southern Vectis (902) from Brighton Hove and District in 1955, never entered service, disposed of in 1957. -

Australian Bus PANORAMA

1 Volume 29.6 ISSN 0817-0193 May-June 2014 $9.00 rrp Australian Bus PANORAMA Registered by Australia Post—Publication No. PP 349069/00039 IN THIS ISSUE: A CENTENARY OF BOLTONS COACH AND BODY BUILDING FROM 1888 TO 1989 VICTORIAN STATE ELECTION 2014 O’CONNELL’S OF OMEO ADELAIDE’S NEW CITYFREE SERVICE 2 Three examples of how the body styling of both J.W. Boltons and Boltons Ltd changed over the decades. TOP: The last body style to be produced for Transperth is shown on (702) a 1988 Renault PR180.2 artic seen loading in St Georges Tce on a wet July morning in 1996. (Geoff Foster) CENTRE: This 1967 Leyland Tiger Cub was MTT 756 but is seen in later ownership by Horizons West. Similar bodies were built on Leopard and Panther chassis (Geoff Foster) BOTTOM: This 1952 Leyland Royal Tiger was built by Boltons for Metro Buses as (106) and is now preserved. (Bruce Tilley) 3 AUSTRALIAN BUS PANORAMA Vol 29 .6 May-June 2014 $9.00 rrp CONTENTS 4 A Centenary of Boltons Coach and body building, 1888-1989 8 Victorian State Election 2014 11 O’Connells of Omeo 12 Adelaide’s New Cityfree Service 14 National News Roundup 29 Pictorials 27 Fleet News COVER PHOTO: In their guises of Boltons Ltd and J.W. Bolton, this company bodied many of Perth’s government buses from the 1940s to the late 1980s. One example from 1983 is MTT (419) a J.W. Bolton Mercedes 0305 with later style rounded front. This photo was one in a series of postcard pictures which could be purchased from the Metropolitan Transport Trust in the 1980s. -

© Norwich Bus Page 2017 1St June 2017 Fleet No. Registration Chassis/Body Livery Notes/Branding 20501 AO02RBY Volvo B12M Plaxto

© Norwich Bus Page 2017 1st June 2017 Fleet No. Registration Chassis/Body Livery Notes/Branding 20501 AO02RBY Volvo B12M Plaxton Paragon -- 20515 WV02EUR Volvo B12M Plaxton Paragon Training Vehicle 32100 LT02ZCJ Volvo B7TL Plaxton President -- 32101 LT02ZCK Volvo B7TL Plaxton President -- 32105 LT02ZCU Volvo B7TL Plaxton President -- 32106 LT02ZCV Volvo B7TL Plaxton President -- 32107 LT02ZCX Volvo B7TL Plaxton President -- 32112 LT02ZDL Volvo B7TL Plaxton President -- 32201 LT52WTF Volvo B7TL Plaxton President -- 32203 LT52WTJ Volvo B7TL Plaxton President -- 33003 LK51UZS Dennis Trident Plaxton President -- 33055 LN51GKO Dennis Trident Plaxton President -- 33060 LN51GJU Dennis Trident Plaxton President -- 33113 LT02NVX Dennis Trident Plaxton President -- 33126 LT02NVO Dennis Trident Plaxton President -- 33150 LR02LXJ Dennis Trident Plaxton President -- 33152 LR02LXL Dennis Trident Plaxton President -- 33154 LR02LXN Dennis Trident Plaxton President -- 33155 LR02LXO Dennis Trident Plaxton President -- 33157 LR02LXS Dennis Trident Plaxton President -- 33159 LR02LXU Dennis Trident Plaxton President -- 33160 LR02LXV Dennis Trident Plaxton President -- 33161 LR02LXW Dennis Trident Plaxton President -- 33162 LR02LXX Dennis Trident Plaxton President -- 33163 LR02LXZ Dennis Trident Plaxton President -- 33164 LR02LYA Dennis Trident Plaxton President -- 33165 LR02LYC Dennis Trident Plaxton President -- 33166 LR02LYD Dennis Trident Plaxton President -- 33167 LR02LYF Dennis Trident Plaxton President -- 33168 LR02LYG Dennis Trident Plaxton President -

Nr Tablic Nazwa Wyprod Wprowa Rok Wy Zezło Inne

Nr Tablic Nazwa Wyprod Wprowa Rok wy Zezło Inne 5030 PJB 283 Scania CN113CLL 1993 2010 2012 2012 5061 JZL 135 Scania CN113CLL 1994 2010 2010 2011 5053 KBB 435 Scania CN113CLL 1994 2010 2015 ? 5050 JYE 045 Scania CN113CLL 1994 2010 2013 2013 5160 COJ 063 Scania CN113CLL 1995 2010 2011 5054 JZZ 385 Scania CN113CLL 1995 2010 2011 2011 2120 АР 131 22 Scania CN113CLL 1995 2010 2011 5048 KCD 115 Scania CN113CLL 1995 2010 2012 2012 5058 KBL 345 Scania CN113CLL 1995 2010 2010 2011 5038 KDM 225 Scania CN113CLL 1995 2010 2016 5161 COW 053 Scania CN113CLL 1995 2010 2011 5059 KCU 465 Scania CN113CLL 1995 2010 2011 2011 5140 EKC 785 Scania CN113CLL 1996 2010 2014 5080 MLR 096 Scania CN113CLL 1996 2010 2012 5137 EKC 655 Scania CN113CLL 1996 2010 4032 ATZ 552 Volvo B10L-60 / Säffle 5000 1996 2010 2011 5109 HYP 268 Scania CN113CLL 1996 2010 5071 MGR 486 Scania CN113CLL 1996 2010 2012 2012 5079 NZY 396 Scania CN113CLL 1996 2010 2012 5121 EJJ 825 Scania CN113CLL 1996 2010 5123 EJN 695 Scania CN113CLL 1996 2010 5125 EJN 765 Scania CN113CLL 1996 2010 5128 EJN 845 Scania CN113CLL 1996 2010 5134 EJP 995 Scania CN113CLL 1996 2010 5101 HUW 048 Scania CN113CLL 1996 2010 5139 EKC 765 Scania CN113CLL 1996 2010 5130 EJO 665 Scania CN113CLL 1996 2010 Zaprawdę na etanol jeździ niniejszy autobus 5138 EKC 675 Scania CN113CLL 1996 2010 5072 LZO 346 Scania CN113CLL 1996 2010 2012 2012 5100 HWR 098 Scania CN113CLL 1996 2010 5103 JAB 178 Scania CN113CLL 1996 2010 5105 HZP 308 Scania CN113CLL 1996 2010 5120 EJJ 635 Scania CN113CLL 1996 2010 5083 LYP 216 Scania CN113CLL 1996